In the world of online trading, the term pocket option regulated pocket option regulated carries substantial weight. Regulation is critical for ensuring the integrity, security, and trustworthiness of trading platforms. As traders continue to seek safe and reliable venues for their investments, understanding the regulatory landscape becomes essential. In this article, we will explore what it means for a trading platform to be regulated, the specific regulations applied to Pocket Option, and its implications for traders.

What is Regulation in Trading?

Regulation in the trading industry refers to the system of laws and rules established by government authorities and regulatory bodies to oversee financial markets and protect investors. Regulatory agencies are tasked with ensuring fair practices, market integrity, and the overall health of the financial ecosystem. They provide a framework to hold brokers accountable and safeguard traders against fraud and mismanagement.

Why is Regulation Important?

For traders, choosing a regulated platform is crucial for several reasons:

- Trust and Credibility: Regulated brokers are required to adhere to strict standards, which enhances their credibility in the eyes of traders.

- Investor Protection: Regulatory frameworks often include measures that protect investors’ funds, including segregated accounts and compensation schemes.

- Market Integrity: Regulation discourages fraudulent practices and manipulative behaviors, promoting fair trading conditions.

- Access to Resources: Regulated platforms typically provide traders with access to educational resources, tools, and support systems that foster a better trading environment.

Pocket Option: An Overview

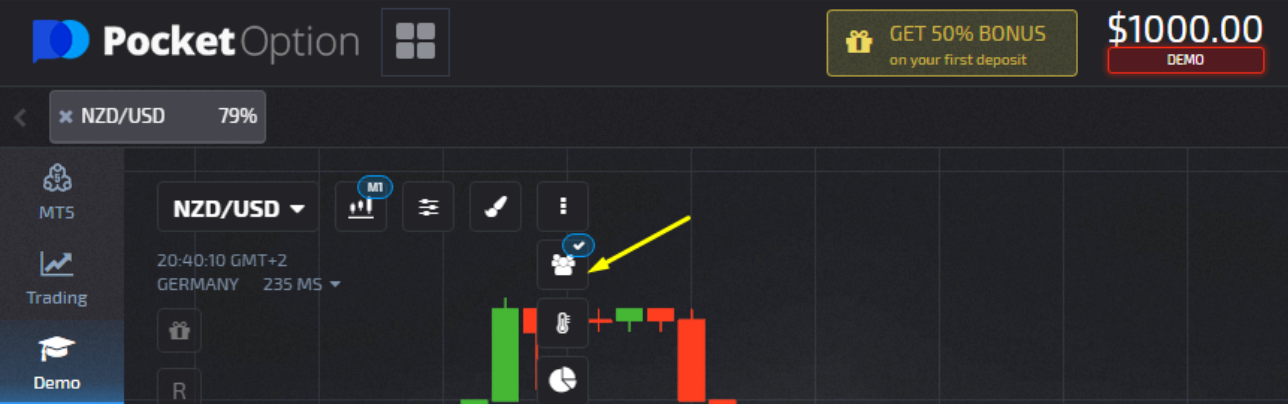

Pocket Option is a popular online trading platform that offers a range of financial instruments, including forex, commodities, stocks, and cryptocurrencies. Launched in 2017, it has quickly gained recognition for its user-friendly interface and various trading features. However, the question of regulation has been pivotal in establishing its reputation among traders.

Is Pocket Option Regulated?

Pocket Option operates under the regulatory oversight of the International Financial Market Relations Regulation Center (IFMRRC). While this organization is not as widely recognized as some major regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the USA, the fact that Pocket Option is regulated is a positive indicator for many traders.

The IFMRRC focuses on establishing an environment in which traders can operate securely and transparently. It sets forth guidelines for proper trading conduct, ensuring that brokerages like Pocket Option maintain standards that benefit both traders and the platform’s operations.

Benefits of Trading on a Regulated Platform like Pocket Option

Trading with a regulated broker such as Pocket Option presents several advantages:

- Peace of Mind: Knowing that a regulatory body oversees the platform can alleviate concerns about fraud and mismanagement.

- Transparency: Regulated platforms are typically required to disclose information about their operations and financial health, allowing traders to make informed decisions.

- Dispute Resolution: In the event of a dispute, regulated brokers usually have procedures in place to resolve issues more effectively.

- Increased Trust: Traders are more likely to trust a platform that operates under the scrutiny of a regulatory body.

Considerations for Traders

While Pocket Option’s regulated status is reassuring, traders should also be aware of the following considerations:

- Regulatory Scope: Understand the specific regulatory environment in which the broker operates. Some regulations may be less robust than others.

- Geographic Restrictions: Be informed about any geographic restrictions that may affect your ability to trade on Pocket Option based on your location.

- Trading Fees and Conditions: Always read the fine print regarding trading fees, spreads, and conditions to ensure that they align with your trading strategy.

Conclusion

The regulation of trading platforms like Pocket Option serves as a cornerstone of trust and security in the financial markets. While Pocket Option operates under the oversight of the IFMRRC, it remains essential for traders to conduct their own research and understand how regulation impacts their trading experience. By prioritizing trading platforms that are regulated, traders can significantly reduce their risks and foster a more secure trading environment.

In summary, as the online trading landscape continues to evolve, staying informed about the regulatory status of platforms like Pocket Option is more important than ever. It empowers traders to make educated decisions, helping them navigate the complexities of the financial markets with confidence.